Together with the University of New South Wales (UNSW), we are delighted to share the first-ever State of Repair report where we have gathered essential insights from across the off-grid energy sector in the Global South – examining the current state of repair services.

SolarAid has been working on the repair of non-functioning solar products for several years, as early as 2008 in Malawi. Learning from the challenges we have faced and solutions we have created, we decided to open up our work to the wider sector last year after publishing our white paper in collaboration with UNSW, resulting in the co-creation of the State of Repair report, which includes insights from 75 of our sector colleagues – thank you!

Though there is much promise, this report unearths some of the real challenges we face in addressing Repair as a whole sector.

This is the first step of our next phase in Repair. While originally an ambitious two-year programme for ‘SolarAid & partners’, this report and our deeper consultation with the key partners inspired us to announce our intentions to launch the Off-Grid Solar Repair Lab at this year’s Global Off-Grid Solar Forum and Expo in Nairobi – putting all of our efforts under one clear strategy.

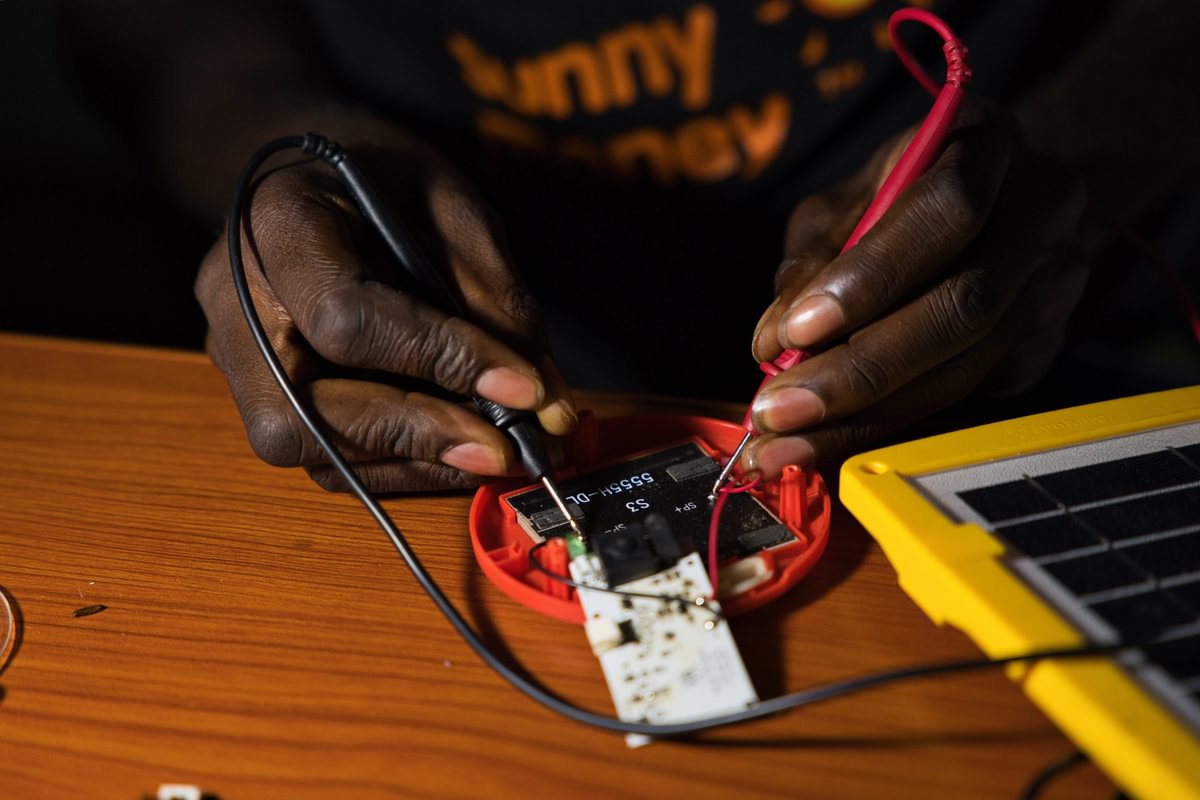

Repair of a solar light in Zambia. Photo: SolarAid/Jason Mulikita

Why is repair important?

In the white paper shared in 2023, it was estimated that 75% of all solar products sold to date in sub-Saharan Africa are now non-functioning. That’s 110 million lights. While it makes sense that many of these products reached their intended ‘end of life’, we discovered that almost all of them are still within rural households (89%) and that almost all were repairable (91%).

We discovered that many of the customers of these products form a sentimental attachment to the solar lights, and hold on to them with hope for them to be repaired. Many of them have already tried through the vibrant rural repair economy that exists in rural sub-Saharan Africa, but for different reasons, these repairs almost always fail to last.

As a wider sector, we have been slow to offer these services ourselves or to equip the informal repair economy with the tools to repair effectively. Warranties are not enough, particularly in rural areas where households have limited incomes. With the potential to extend the lifespan of a household’s existing product, we can provide a service that is wanted while tackling the drastically growing e-waste problem this sector urgently needs to address.

Through this insight, we are launching the State of Repair report, as we firmly believe that if we collectively tackle the barriers ahead of us, repair services can be an overall net benefit to the off-grid solar sector, financially and otherwise.

About the State of Repair Report

While experiencing the benefits and challenges of offering repair services and conversing with many partners, we wanted to cast the net wider to give all stakeholders a say in the current State of Repair based on their own successes and challenges.

This was also an important step for us in order to confirm that our next phase of Repair is ‘fit-for-purpose’ and to take the first step in whole-sector collaboration, which we will be heavily focused on.

Participants at a solar repair training in Lusaka, Zambia. Photo: SolarAid/Jason Mulikita

Key findings

The variety

The level of engagement for this report exceeded our expectations. The report is based on answers from 75 respondents from all over the sector, including distributors (of all sizes, product types and ages) making up the highest proportion (31%). We were also able to feature manufacturers, investors, vertically integrated companies, donors, and others, which gave us a great variety.

The celebration

We are pleased to see that 90% of distributors are offering some form of repair service already. The remaining 10% are smaller companies not yet with the capacity to offer them, but most are proactive in considering repair for the future.

While the most common form of repair was a centralised approach, there were still many offering decentralised repairs to resolve minor issues, and a minority working with third party repairers but many had an openness to explore this further.

The motivation to repair was most commonly for ‘reputation and customer loyalty’, with ‘cost savings’, and ‘improved environmental sustainability’ following. This shows a customer centric approach, which we were delighted to see.

This snapshot has provided a fantastic insight into the types of possible services we can celebrate and share as we are moving forward in a sector which is positively inclined to repair products.

The challenges

One of most interesting insights was the disparity between distributors and manufacturers. When asked to rate the different facets of Repair, manufacturers consistently rated their experiences higher. For example, when asked about ‘manufacturer support’, manufacturers rated this at 4.8 with distributors rating it at 2.6. The disparity is explored throughout the report and highlights the needs for us to work collectively to find solutions.

Accessing spares was ranked the highest of all challenges with long lead times and difficulties acquiring affordable parts altogether disrupting high-quality services. Promisingly however, manufacturers acknowledged this challenge and the logistical challenge that comes with it.

Related to the above were the reported challenges of the ‘Cost of Repair’, ‘Last Mile Logistics’, ‘Training’, ‘Restrictive Product Design’ and ‘Product Tampering’. The direct quotes from all were enlightening and the breadth of challenges confirmed our own experiences.

The opportunity

Since the launch of our white paper last year, we have been overwhelmed with outreach and partnership opportunities to the extent that we have not been able to keep up. The participation in this following report has given us an overview of the amazing work being done by our colleagues, as well as, clear challenges for us to resolve.

For example, when asking the companies to indicate how they could be best supported, the answers mirrored the programme we are currently developing together with key partners. Companies are looking for better access to spares, more guidance from manufacturers, business model guidance and much more.

We, with partners, have planned to tackle much of this, and having this plan confirmed more broadly by 75 sector players was heartening. We hope this report will help trigger more conversation and collaboration.

Our Opportunities and Solutions section highlights not just our recommendations but many of the solutions we have already worked on or are planning.

More than that, we are looking for collective action. While SolarAid is working on replicable tools and business models to solve some of the critical challenges, the scope has widened to include some incredible partners working on advocacy, research and sector coordination.

At the Global Off-Grid Solar Expo and Forum, we announced our intention to launch the Off-Grid Solar Repair Lab and had many fantastic meetings with partners to plan.

Our ambition is to set the path for this to grow far beyond ourselves, if we do not, we fail our customers, we fail the environment and we risk the future growth of our sector.

Expect to hear much more in the next couple of months when we formally announce our launch together with the most amazing partners.

Jamie McCloskey, Director of Programmes and Partnerships

________

Thank you so much to Paul and Shanil at the University of New South Wales (UNSW) for being the best research partners we could wish for.